main.set_up_cost

main.digital

main.secure

main.title

main.subtitle

main.early_2026

features.title

features.items.backend

features.items.client_platform

features.items.advisory_platform

features.items.automated

features.items.ai_assistant

features.items.integration

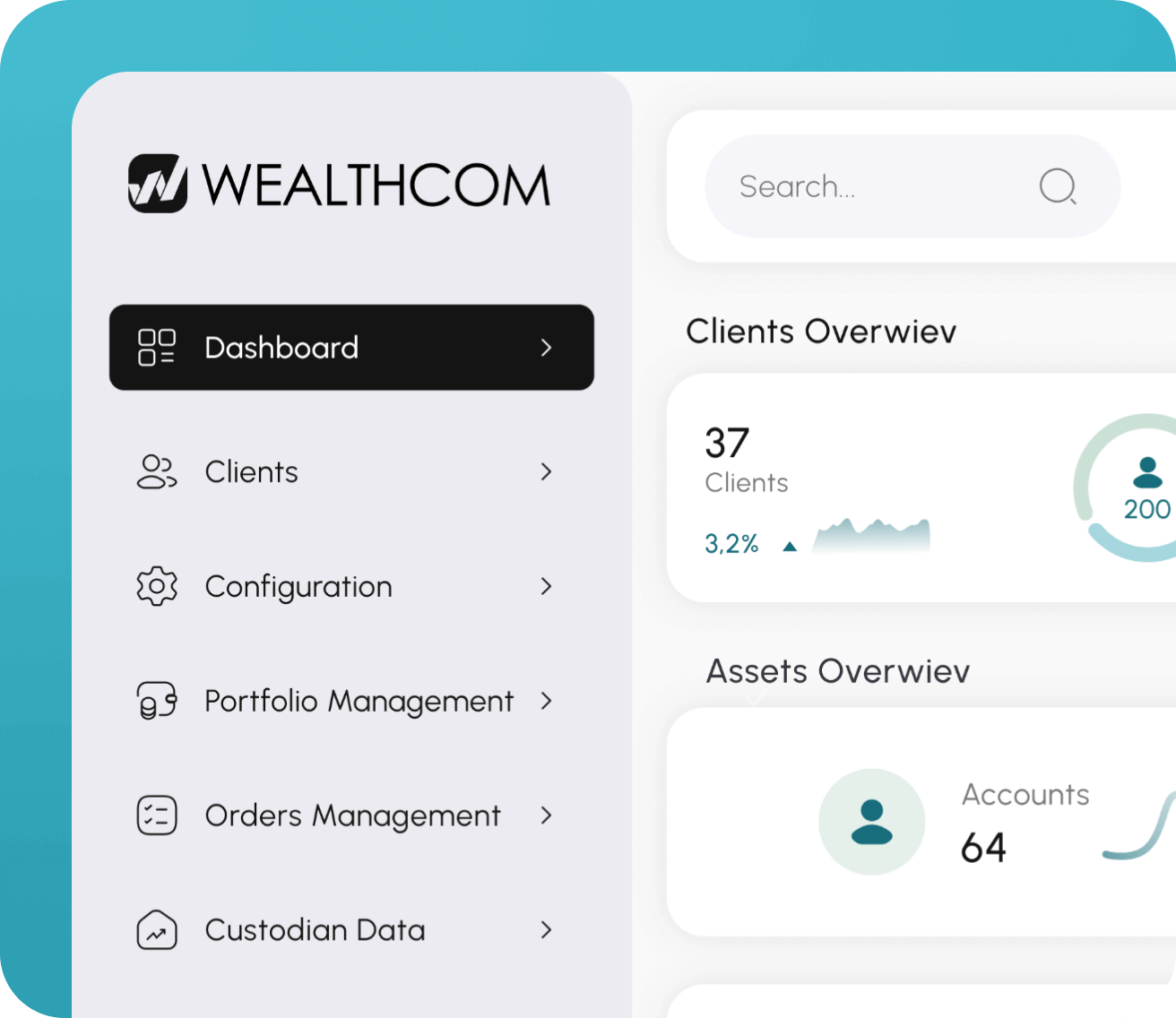

products.title

products.description

products.pms

products.oms

products.custodian_interfaces

products.asset_mgmt

products.designed_for

products.tailored

products.ready_to_subscribe

products.flexible_cost

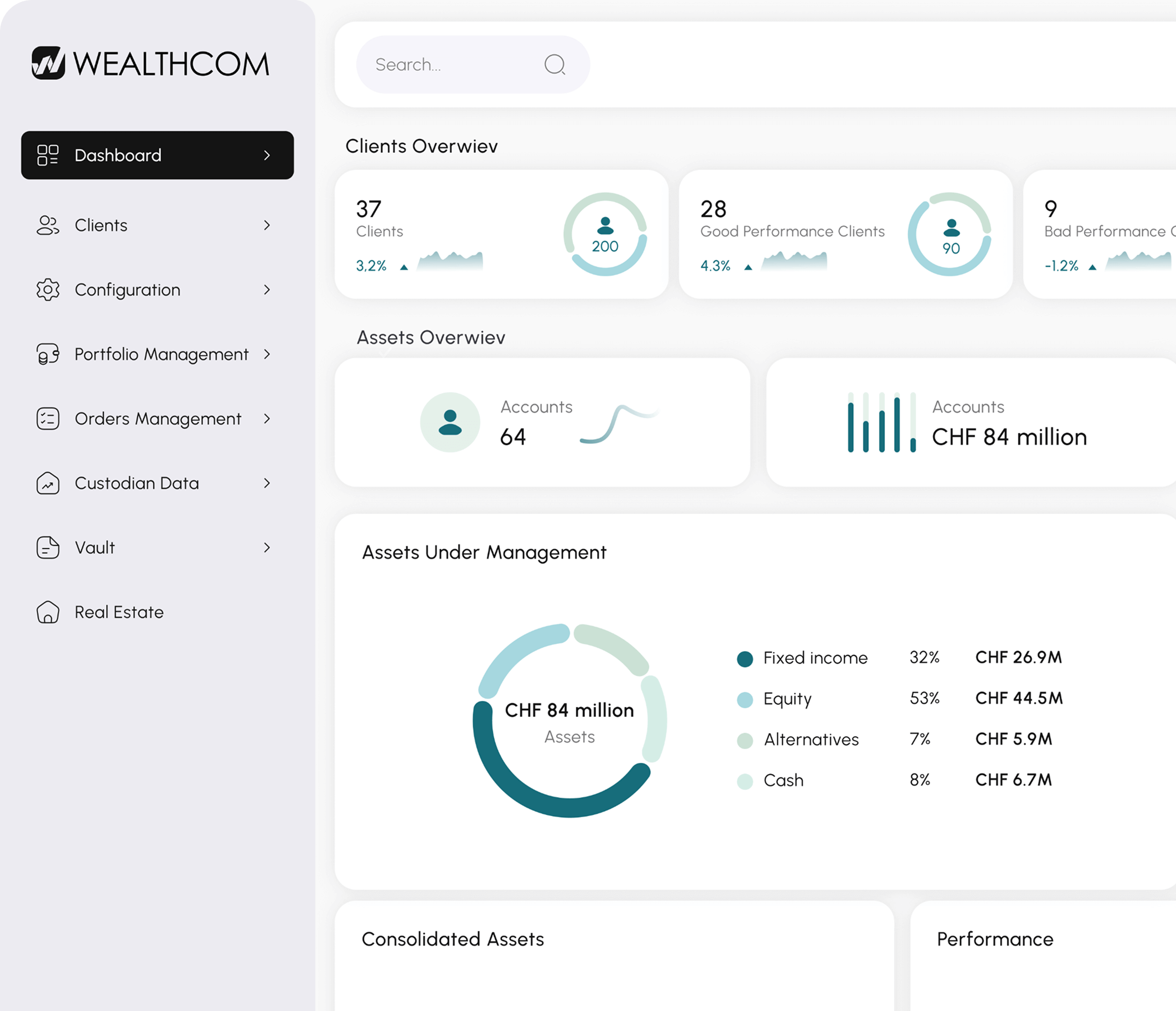

advisorCockpit.title

- advisorCockpit.features.onboarding

- advisorCockpit.features.strategies

- advisorCockpit.features.breach_monitoring

- advisorCockpit.features.risk_profiling

- advisorCockpit.features.autonomy

- advisorCockpit.features.overview

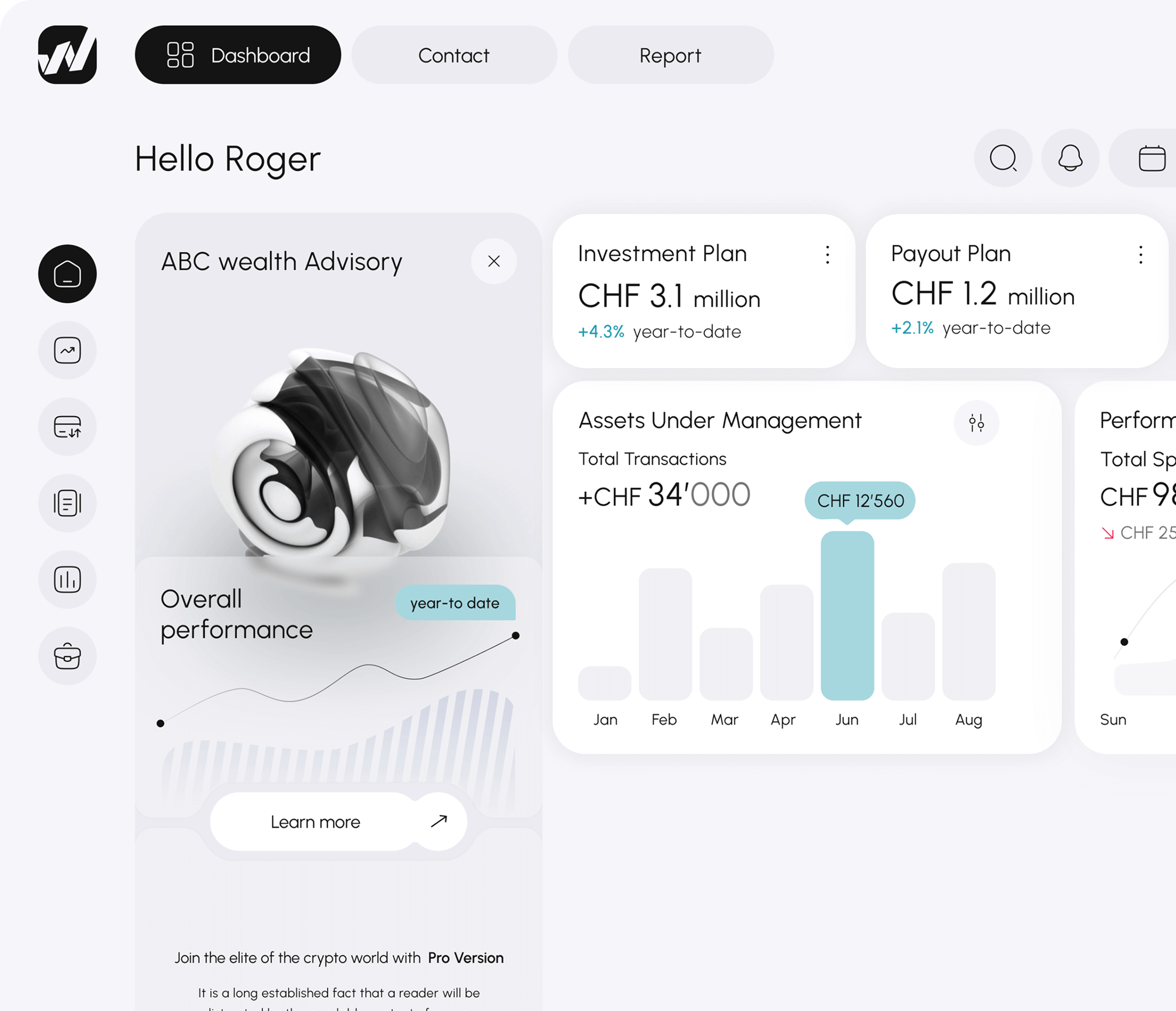

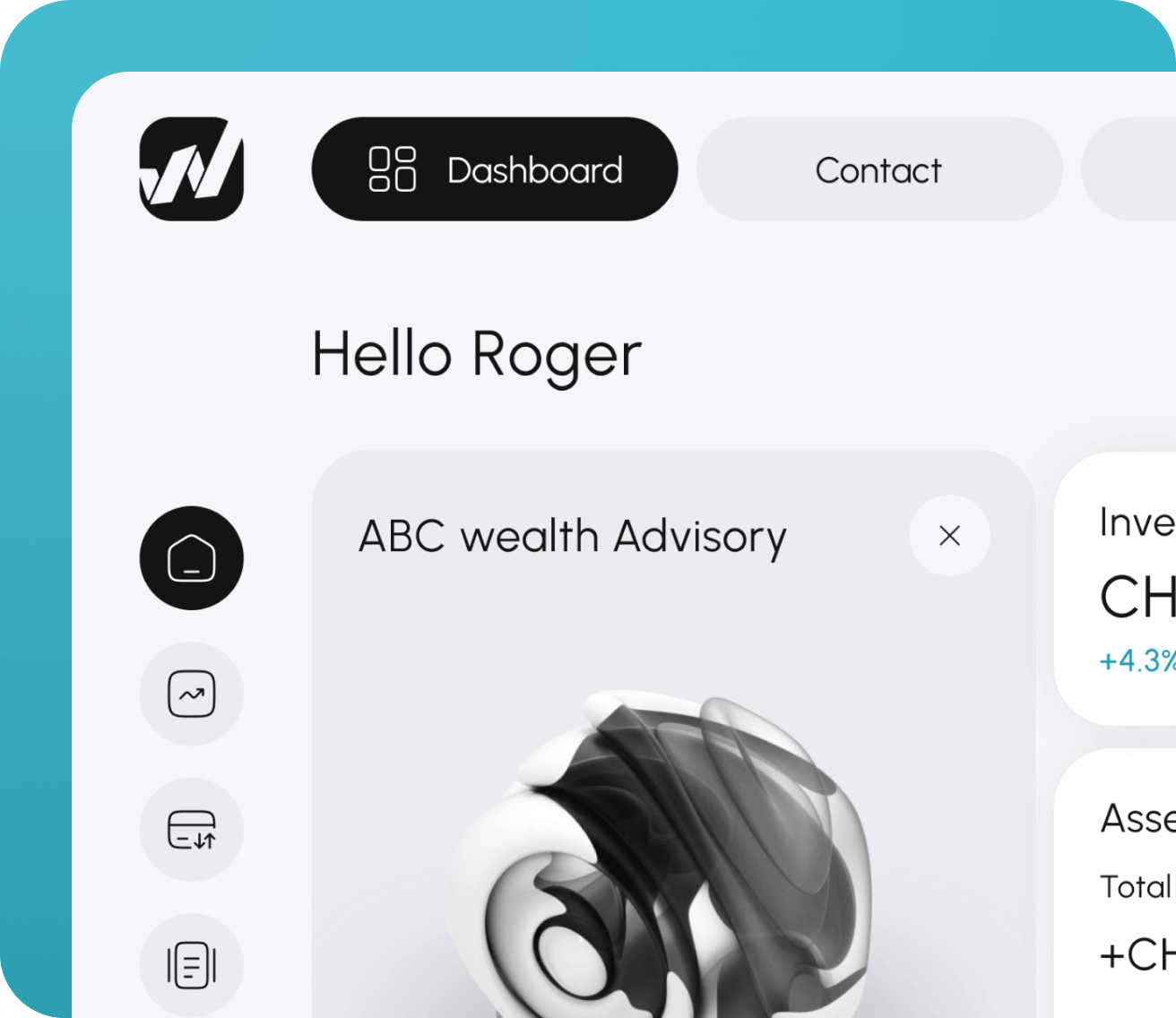

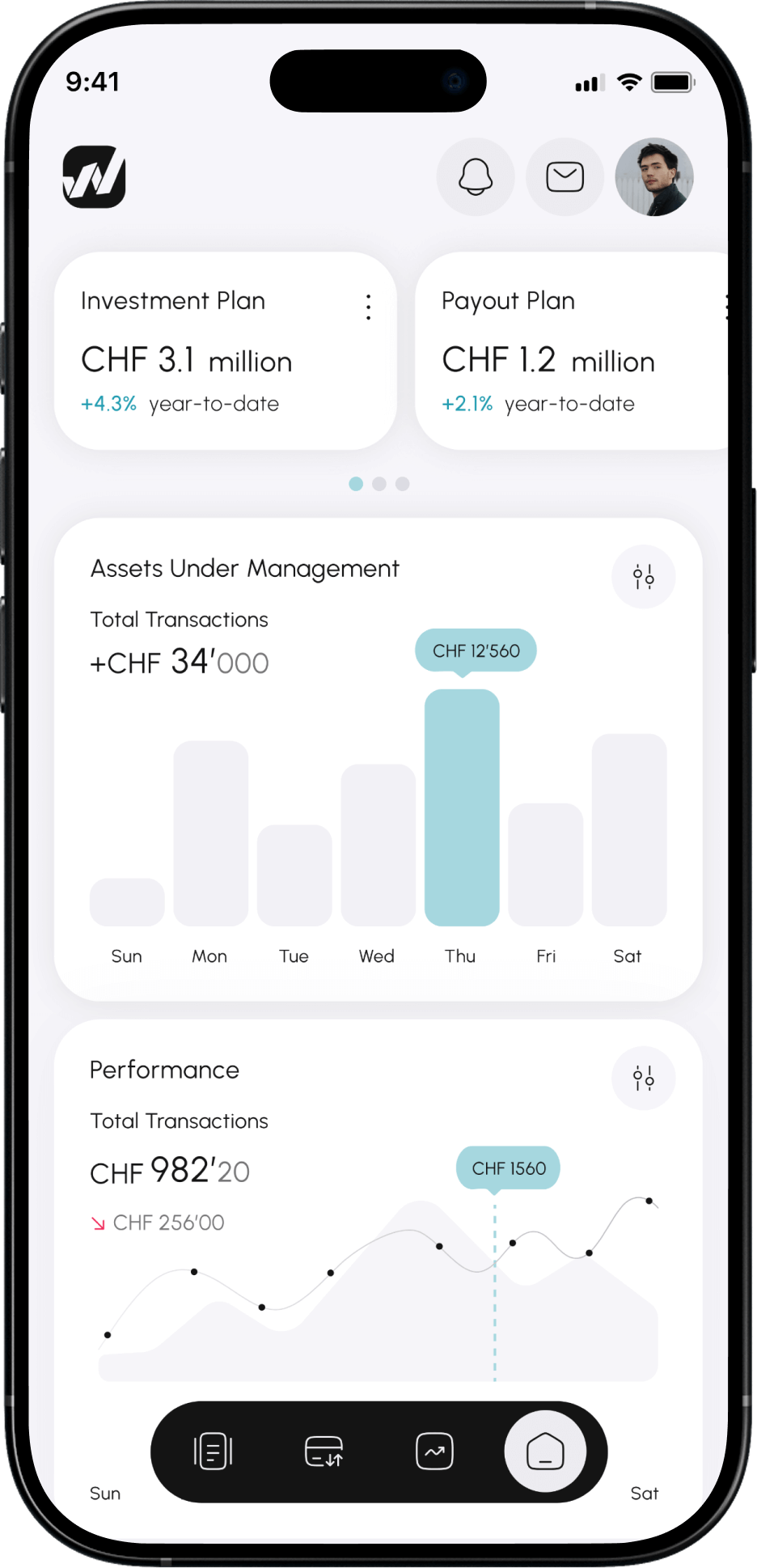

clientCockpit.title

- clientCockpit.features.quick_view

- clientCockpit.features.overview

- clientCockpit.features.documents

- clientCockpit.features.drill_down

- clientCockpit.features.strategy_changes

- clientCockpit.features.messaging

- clientCockpit.features.white_label

serviceCategories.title

serviceCategories.subtitle

01/

serviceCategories.services.ifa

02/

serviceCategories.services.eam

03/

serviceCategories.services.family_office

04/

serviceCategories.services.service_platforms

05/

serviceCategories.services.trusts

06/

serviceCategories.services.private_banks

distinguishes.title

distinguishes.features.simplicity.title

distinguishes.features.simplicity.subtitle

distinguishes.features.client_app.title

distinguishes.features.client_app.subtitle

distinguishes.features.ai_native.title

distinguishes.features.ai_native.subtitle

distinguishes.features.flexible.title

distinguishes.features.flexible.subtitle

saveAndInvest.title

saveAndInvest.items.wealth_mgmt

saveAndInvest.items.agentic_ai

saveAndInvest.items.roadmap

agenticAI.title

- agenticAI.features.proposal_generation

- agenticAI.features.tactical_changes

- agenticAI.features.personal_assistant

- agenticAI.features.proactive_outreach

- agenticAI.features.investment_proposals

custodian.title

- custodian.features.integrated_view

- custodian.features.automated_consolidation

- custodian.features.integrated_trading

- custodian.features.more_banks

- custodian.features.ai_integration

founders.title

founders.elmo.name

founders.elmo.role

- founders.elmo.companies.xtoniq

- founders.elmo.companies.fintech

- founders.elmo.companies.deloitte

- founders.elmo.companies.credit_suisse

- founders.elmo.companies.raiffeisen

- founders.elmo.companies.det_norske

founders.elmo.description

founders.ralf.name

founders.ralf.role

- founders.ralf.companies.ubs_wealth

- founders.ralf.companies.ubs_vaudoise

- founders.ralf.companies.fintech_scaleup

- founders.ralf.companies.mckinsey

- founders.ralf.companies.phd

founders.ralf.description

faq.title

faq.questions.q1.number

faq.questions.q1.question

faq.questions.q2.number

faq.questions.q2.question

faq.questions.q3.number

faq.questions.q3.question

faq.questions.q4.number

faq.questions.q4.question

contactForm.title

contactForm.subtitle